A Biased View of Stonewell Bookkeeping

Wiki Article

All about Stonewell Bookkeeping

Table of ContentsRumored Buzz on Stonewell BookkeepingSee This Report on Stonewell BookkeepingThe Buzz on Stonewell BookkeepingThings about Stonewell BookkeepingGetting My Stonewell Bookkeeping To Work

Every business, from handcrafted cloth makers to game designers to dining establishment chains, makes and invests cash. You could not fully recognize or also begin to fully value what an accountant does.The history of accounting days back to the beginning of business, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained records on clay tablet computers to keep accounts of purchases in remote cities. It consisted of a day-to-day journal of every transaction in the sequential order.

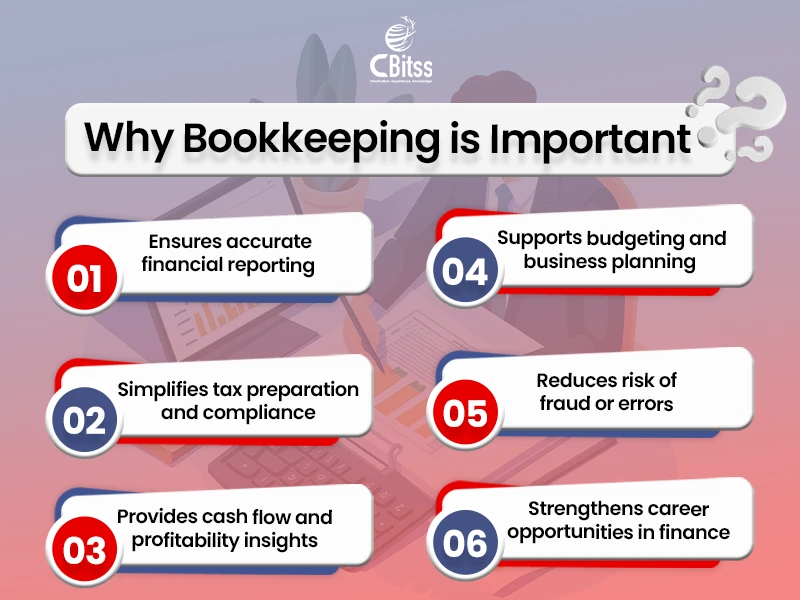

Small businesses might count exclusively on an accountant at initially, yet as they grow, having both experts on board comes to be progressively beneficial. There are two main types of bookkeeping: single-entry and double-entry bookkeeping. documents one side of an economic purchase, such as adding $100 to your cost account when you make a $100 purchase with your credit card.

Getting The Stonewell Bookkeeping To Work

involves recording financial purchases by hand or making use of spread sheets - business tax filing services. While low-cost, it's time consuming and susceptible to errors. uses tools like Sage Cost Administration. These systems immediately sync with your bank card networks to give you credit rating card deal information in real-time, and instantly code all data around expenses consisting of tasks, GL codes, locations, and classifications.Furthermore, some accountants also assist in enhancing pay-roll and invoice generation for an organization. An effective bookkeeper needs the adhering to abilities: Accuracy is key in financial recordkeeping.

They generally begin with a macro perspective, such as an annual report or a profit and loss declaration, and after that pierce right into the information. Bookkeepers guarantee that vendor and customer documents are constantly up to date, also as people and companies change. They might likewise need to collaborate with other departments to ensure that everyone is making use of the exact same data.

Facts About Stonewell Bookkeeping Revealed

Bookkeepers quickly process inbound AP deals on time and see to it they are well-documented and easy to audit. Going into costs into the accountancy system permits precise preparation and decision-making. Bookkeepers rapidly develop and send billings that are easy to track and duplicate. This aids companies receive settlements quicker and improve capital.This aids avoid disparities. Bookkeepers routinely conduct physical supply counts to prevent overemphasizing the worth of properties. This is an important aspect that auditors thoroughly examine. Include interior auditors and compare their matters with the videotaped worths. Accountants can work as consultants or in-house employees, and their payment differs relying on the nature of their work.

That being stated,. This variant is affected by elements like location, experience, and skill degree. Consultants commonly bill by the hour yet might supply flat-rate plans for certain tasks. According to the US Bureau of Labor Data, the ordinary accountant salary in the United States is. Bear in mind that salaries can differ depending upon experience, education, area, and industry.

That being stated,. This variant is affected by elements like location, experience, and skill degree. Consultants commonly bill by the hour yet might supply flat-rate plans for certain tasks. According to the US Bureau of Labor Data, the ordinary accountant salary in the United States is. Bear in mind that salaries can differ depending upon experience, education, area, and industry.The Ultimate Guide To Stonewell Bookkeeping

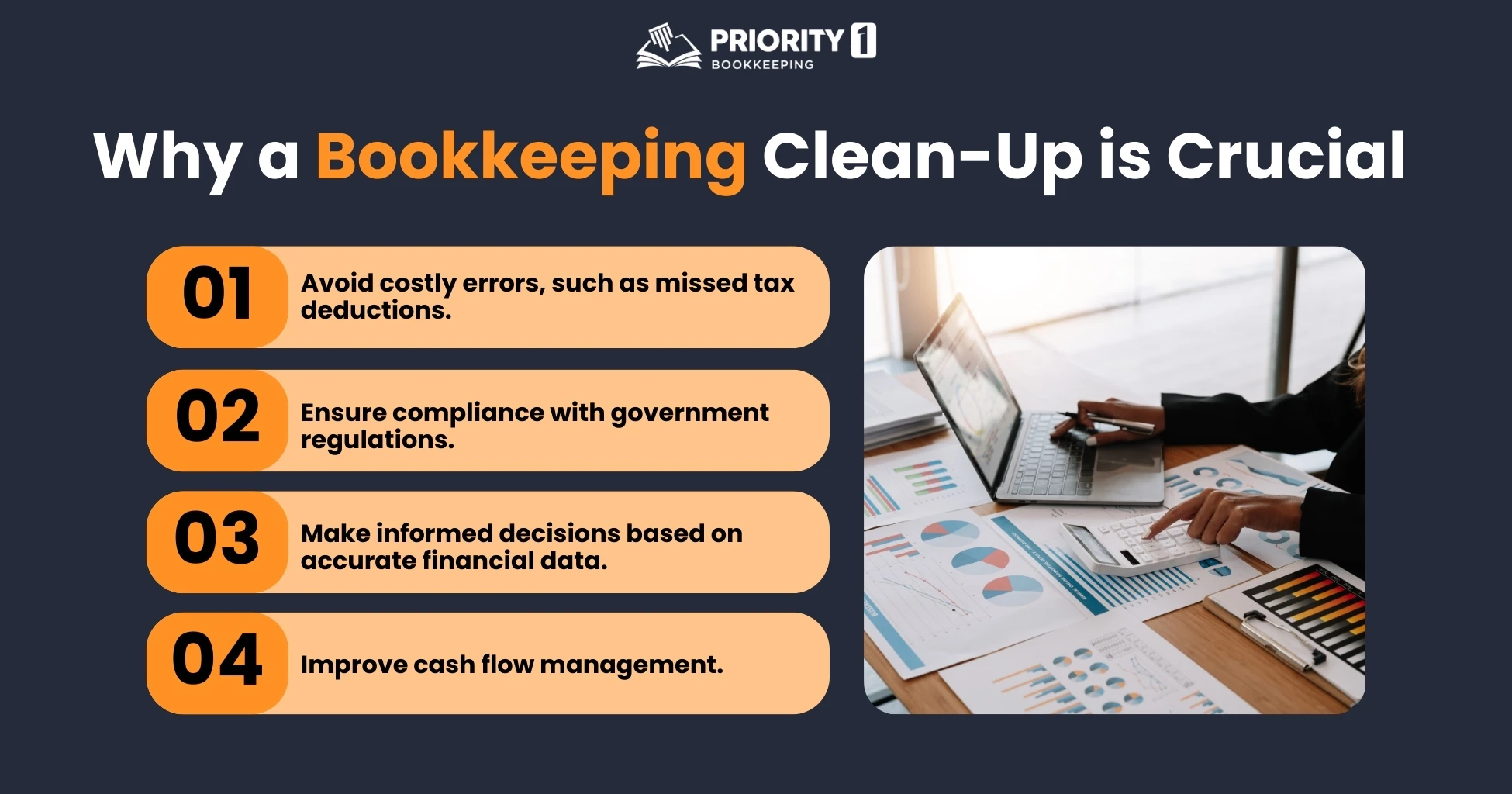

A few of one of the most usual paperwork that organizations should send to the federal government includesTransaction info Financial statementsTax conformity reportsCash flow reportsIf your bookkeeping depends on day all year, you can prevent a lots of anxiety during tax season. bookkeeping services near me. Persistence and focus to detail are try this website key to far better bookkeeping

Seasonality is a part of any type of work in the world. For bookkeepers, seasonality indicates periods when settlements come flying in via the roof covering, where having outstanding job can end up being a serious blocker. It comes to be important to expect these moments ahead of time and to complete any kind of backlog prior to the stress duration hits.

A Biased View of Stonewell Bookkeeping

Preventing this will decrease the danger of triggering an internal revenue service audit as it gives an accurate representation of your funds. Some common to keep your individual and business financial resources separate areUsing a service charge card for all your service expensesHaving different monitoring accountsKeeping receipts for personal and overhead separate Visualize a world where your bookkeeping is done for you.These assimilations are self-serve and need no coding. It can immediately import data such as employees, jobs, classifications, GL codes, divisions, task codes, expense codes, taxes, and extra, while exporting expenditures as costs, journal entrances, or credit score card costs in real-time.

Take into consideration the complying with suggestions: An accountant who has actually functioned with services in your industry will certainly much better comprehend your details needs. Ask for referrals or check on-line reviews to guarantee you're hiring a person reputable.

Report this wiki page